How is the recession affecting the mental health of Americans? What I am seeing is that either people have plenty of money and haven’t been hurt that much, or they have virtually no money and they’re hurt a lot. The ones hurting a lot can’t sleep, they are depressed, anxious … and amazingly the ones with no money are usually making a good living … $50,000 a year and often much more, but they report that money doesn’t go far these days and, yes, they’ll admit that they’ve bought more house, car and clothes than they can afford, among other things. (Parade magazine today defines America’s middle class as those making between $40,000 and $200,000).

I’m not a social worker, and my practice is geared toward high-functioning people who typically make a good living … but it is interesting to me that so many with good incomes are barely making it, which causes me to conclude that in America the middle class has almost ceased to exist — probably due to a lack of self control combined with the assistance of greedy credit card companies. Wouldn’t it be great to see the middle class return and experience some of the things our parents did – savings accounts, trips, a new car every few years? So what’s keeping people who should be in the middle class so darn broke? And can’t we come up with another term besides middle class since it just doesn’t feel the same as it used to?

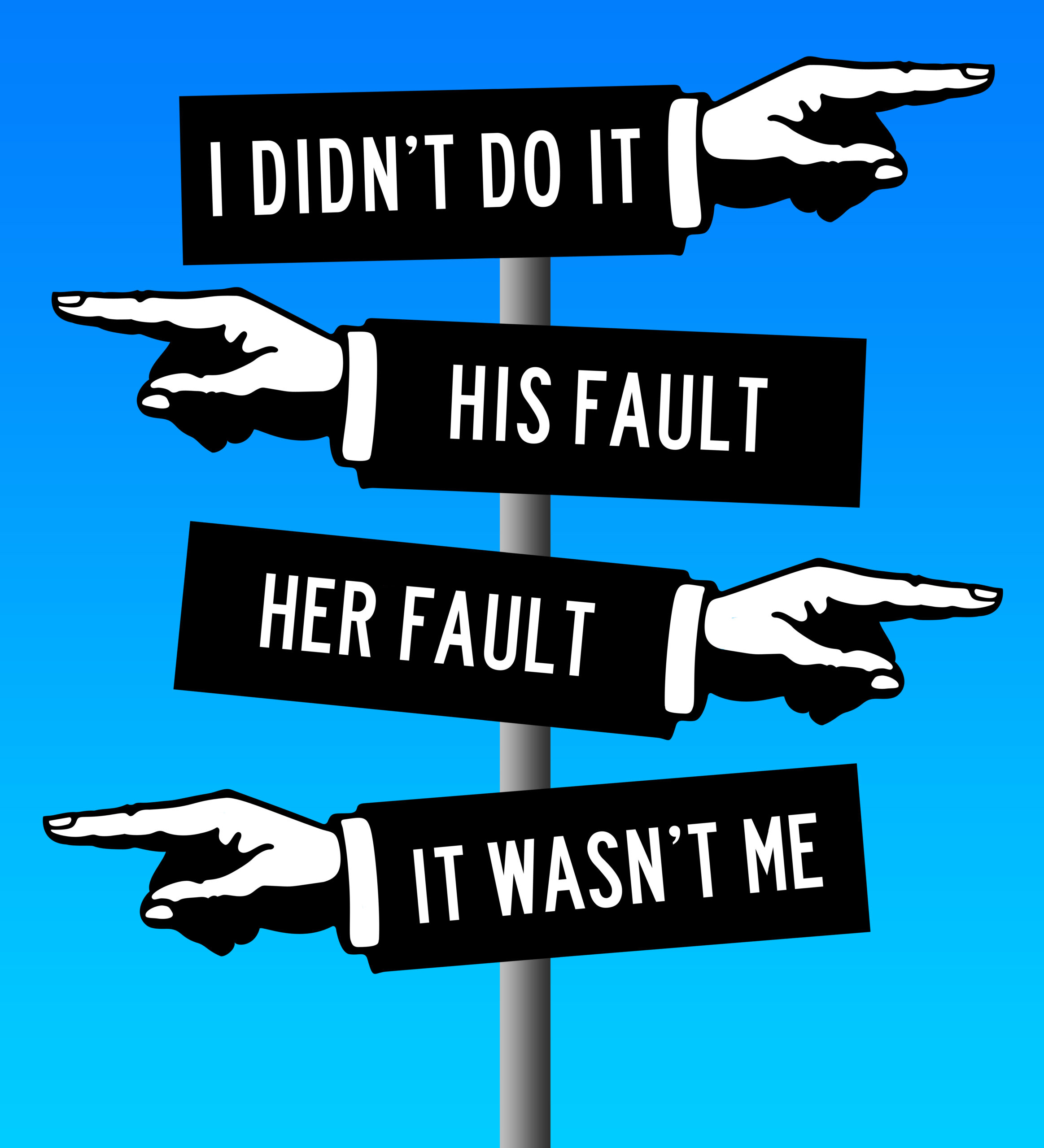

Sandra is a 46-year-old banker with a six-figure income. She is about to be laid off and is terrified of losing it all … she blames herself and others …

“I am drowning in credit card debt and I make a good living,” she says "I did all the stuff like buy a big house and car, then I wanted clothes and TV’s and whatnot, and before I knew it I had $50,000 in credit card debt. One slow payment and the rate got hiked WAY up, and I just don’t think it’s fair.”

I agree. Back in the late 1990’s I got to spend some time on Capitol Hill with lawmakers, and at many of the after work cocktail parties there were lobbyists from Master Card, Discover and Visa standing around like snake oil salesmen at a circus, and what they were selling was getting congressmen to sympathize with their need to gouge the public. If you ask me, these companies are some of the greediest in America – Discover charging up to 31% interest for consumers who exceed their limit twice in a year or miss a payment, and other cards charging up to 32%. This is why Americans are sinking downward and unable to get ahead.

“I want to pay for what I have bought,” says Sandra. “But with a credit card interest rate of 32% all I can do is service the debt, and not pay it down. It is so depressing, and then sometimes I absolutely must charge to get groceries or pay a medical bill, so it keeps adding up.”

What can Americans do? In the age of bailouts for corporations, I think Americans themselves should receive a consumer debt bailout that allows them to pay off their debts at a reasonable rate, and not at the insatiably greedy rates of 20% and above. I work from the idea that we want to pay what we owe, but for heaven’s sake let’s not allow loan shark-like credit card companies to hold us hostage – the current situation is a recipe for depression and anxiety if ever there was one. Perhaps we need a rebellion — let’s raise hell until Congress gets it done.

I’m not an economist, but I have a friend who is. When I told him of my idea to have Congress put a seal on how high credit card companies could raise interest rates, to say 10 percent, he said it was a good idea.

“But it should be tied to the prime lending rate,” says Jim, my CFO friend. “Not just a random and concrete rate. Three percent over the prime rate should be about right. Anything over that is greed.”

So, Americans, what will you do to demand that credit card companies be reasonable?

Becky Whetstone is an Arkansas native and has a Ph.D. in Marriage and Family Therapy from St. Mary’s University in San Antonio, Texas. She is a Licensed Marriage and Family Therapist (LMFT) in Texas and Arkansas.

Becky Whetstone is an Arkansas native and has a Ph.D. in Marriage and Family Therapy from St. Mary’s University in San Antonio, Texas. She is a Licensed Marriage and Family Therapist (LMFT) in Texas and Arkansas.